Entering a business partnership often begins with optimism and shared goals. Yet, while it’s easy to start a business relationship, untangling one can be far more complex. Without clear, professionally drafted agreements in place, disputes and misunderstandings can escalate, jeopardizing not just the partnership but also the business itself. At Barbarian Law, we understand the importance of certainty in commercial contracts, particularly when it comes to planning for both success and unforeseen exits.

The Double-Edged Sword of Business Partnerships

Business partnerships often thrive on collaboration and shared vision. However, even the strongest partnerships can face challenges due to disagreements, changes in priorities, or unexpected events. Without clear terms governing the relationship, these issues can lead to costly disputes or the dissolution of the business.

This is where professionally drafted contracts, such as shareholder agreements, play a critical role. They provide a framework for how the partnership operates, as well as clear protocols for resolving conflicts or dissolving the relationship when necessary.

The Value of Certainty in Shareholder Agreements

A well-drafted shareholder agreement does more than outline roles and responsibilities—it creates certainty by providing mechanisms to address critical scenarios, including exit strategies. These agreements can include provisions such as:

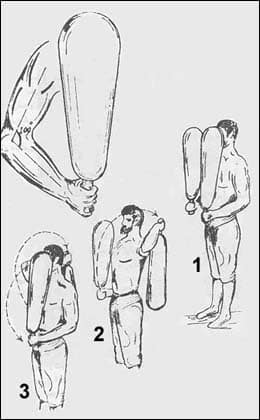

- Shotgun Clauses:

Also known as a buy-sell agreement, a shotgun clause allows one shareholder to offer to buy out the other’s shares at a specific price. The other shareholder must either accept the offer or buy the offering party’s shares at the same price. This mechanism ensures a fair resolution when a partnership can no longer continue. - Right of First Refusal (ROFR):

A ROFR clause gives existing shareholders the first opportunity to purchase shares before they are sold to an outside party. This protects the business from unwanted third-party involvement and maintains stability among the remaining shareholders. - Exit Timelines and Valuations:

Clear timelines and methods for valuing the business during an exit ensure fairness and minimize conflicts. These terms provide clarity and reduce emotional decision-making in high-stress situations. - Dispute Resolution Mechanisms:

Provisions for mediation, arbitration, or other alternative dispute resolution methods help resolve conflicts efficiently and cost-effectively, minimizing disruption to the business.

Planning for Success and the Unexpected

Professionally drafted agreements are not only about planning for exits—they’re about creating a stable foundation for success. A comprehensive shareholder agreement ensures that all parties understand their roles, rights, and obligations, fostering collaboration and accountability.

Key areas these agreements can address include:

- Decision-Making Processes: Establishing voting thresholds for major decisions.

- Profit Distribution: Defining how profits and dividends will be allocated.

- Equity Adjustments: Addressing how additional capital contributions or changes in equity are handled.

- Succession Planning: Preparing for unforeseen events such as illness or death.

By proactively addressing these issues, shareholders can focus on growing the business without worrying about potential ambiguities or conflicts down the line.

The Costs of Uncertainty

Failing to establish clear terms through professionally drafted agreements can lead to significant costs, both financial and emotional. Disputes between shareholders often result in:

- Legal Battles: Expensive litigation that drains resources and diverts focus from the business.

- Business Instability: Uncertainty within the leadership can harm employee morale, client relationships, and overall business performance.

- Lost Opportunities: Prolonged disputes can prevent the business from seizing growth opportunities or responding to market changes.

These risks highlight the importance of investing in robust legal agreements from the outset.

How Barbarian Law Can Help

At Barbarian Law, we specialize in drafting customized commercial contracts tailored to the unique needs of your business. Our expertise includes:

- Unanimous Shareholder Agreements: Providing a comprehensive framework for decision-making, equity distribution, and exit strategies.

- 50-50 Shareholder Agreements: Addressing the complexities of equal partnerships, including provisions for resolving deadlocks.

- Partnership Agreements: Outlining roles, contributions, and dispute resolution mechanisms.

Our goal is to provide clarity and protection, ensuring your business thrives while safeguarding against potential challenges.

Conclusion: Certainty is Key

A successful business partnership isn’t just about shared vision—it’s about having the foresight to plan for every eventuality, including the end of the relationship. Certainty in commercial contracts ensures that partnerships remain productive and that exits, when necessary, are fair and efficient.

At Barbarian Law, we believe that planning for the unexpected is a cornerstone of good business. Contact us today to discuss how we can help you create professionally drafted agreements that provide the certainty your business needs to succeed.