Buying your first home is an exciting milestone, but it’s also one of the most significant financial decisions you’ll ever make. While real estate transactions can seem straightforward, they are riddled with potential pitfalls that can cost you dearly if not handled correctly. At Barbarian Law, we’ve seen common mistakes made by first-time homebuyers that could have been avoided with proper legal guidance. Here are the top five legal mistakes and how to steer clear of them.

1. Entering Firm Purchase Agreements Without Securing Firm Financing

One of the most common and costly mistakes first-time buyers make is signing a firm Agreement of Purchase and Sale (APS) without securing firm financing. An online mortgage quote or pre-qualification is not enough. Before committing to a purchase, ensure you have at least one, if not multiple, firm mortgage offers in hand.

Failing to secure financing can leave you unable to close the deal, exposing you to severe financial and legal repercussions, including losing your deposit or being sued for damages if the seller resells at a lower price. Whenever possible, include a financing condition in your APS to protect yourself from unforeseen issues with your mortgage approval.

2. Skipping Title Insurance

Title insurance is an inexpensive safeguard against potential issues with the property’s ownership history or legal status. Many first-time buyers overlook this critical step, leaving themselves vulnerable to unexpected claims, title defects, or disputes over property boundaries.

Title insurance protects you from:

- Fraudulent claims against your ownership.

- Encroachments or zoning issues.

- Hidden liens or unpaid taxes left by the previous owner.

Purchasing title insurance at the time of closing is a small price to pay for peace of mind and long-term security.

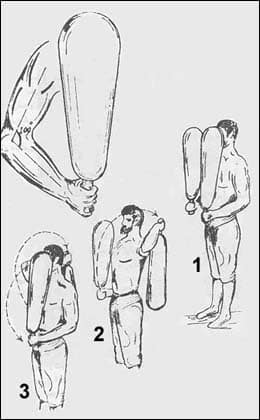

3. Failing to Conduct Thorough Searches and Inspections

Buying a home involves more than just a visual inspection of the property. Neglecting on-title and off-title searches can result in unexpected legal or financial burdens after the sale.

Key searches you should conduct include:

- Title Searches: To ensure the seller has legal ownership and there are no outstanding liens or encumbrances.

- Execution Searches: To identify judgments or debts against the seller that could impact the transaction.

- Off-Title Searches: To check for zoning issues, easements, or environmental concerns that could affect your property use.

Additionally, a professional home inspection is essential to identify structural or maintenance issues that may not be immediately visible. These searches and inspections provide critical insights that can protect you from future headaches.

4. Overpaying for the Property

Realtors are skilled negotiators, but it’s important to remember that their incentives may not align perfectly with yours. Many real estate agents earn a commission as a percentage of the sale price, so they may subtly encourage you to increase your offer to close the deal quickly or win a bidding war.

However, overpaying for a property can strain your finances and reduce your equity. Before making an offer:

- Conduct market research to determine a fair price for the property.

- Don’t be afraid to negotiate aggressively, even in a competitive market.

- Consult a real estate lawyer for advice on how to structure your offer to protect your interests.

Your real estate agent is not your fiduciary—they are not legally bound to prioritize your best financial interests. Having a lawyer review your APS and advise on pricing strategies can prevent you from making costly mistakes.

5. Ignoring Legal Counsel Until It’s Too Late

Many first-time homebuyers make the mistake of assuming they only need a lawyer at the closing stage. In reality, involving a real estate lawyer early in the process can save you from critical errors.

A lawyer can:

- Review your APS to ensure it includes essential conditions like financing and inspection contingencies.

- Advise on legal risks associated with the property.

- Handle searches, title insurance, and all legal documentation.

By proactively seeking legal guidance, you can identify potential issues and address them before they become costly problems.

How Barbarian Law Can Help

At Barbarian Law, we specialize in guiding first-time homebuyers through every stage of the real estate transaction process. Our services include:

- Reviewing and negotiating Agreements of Purchase and Sale.

- Conducting thorough title, execution, and off-title searches.

- Advising on financing conditions and strategies.

- Ensuring you’re protected with title insurance and proper documentation.

Buying your first home should be a rewarding experience, not a legal minefield. With our expert guidance, you can navigate the process confidently and avoid the pitfalls that have caught so many first-time buyers off guard.

Closing Thoughts

Buying a home is more than just a financial investment—it’s a legal commitment that requires careful planning and attention to detail. By avoiding these common mistakes and seeking professional legal advice, you can protect your interests and set the foundation for a successful and stress-free transaction.

If you’re a first-time homebuyer, don’t leave anything to chance. Contact Barbarian Law today to learn how we can help you secure your dream home with confidence.